Apogee Scholarship Fund

Since 2017, we have awarded nearly $2 million in financial aid to Terra families through the Apogee program.

What is Apogee?

Wouldn’t it be great if you could decide how your tax dollars are used? Terra School has partnered with the Apogee Scholarship Fund, a state-approved 501(c)(3) nonprofit Student Scholarship Organization (SSO) that provides scholarships for eligible children to attend private schools like Terra.

Through this partnership, you can contribute to Apogee and receive a dollar-for-dollar credit on your Georgia state income taxes. Apogee manages all contributions and works directly with Terra in the financial aid process.

Signing up takes only a few minutes, and we are here to help!

For questions regarding the Terra Apogee Fund, please reach out to

fundraisingcommittee@terraatserenbe.org

How does it work?

Before December 15th, register your pledge here. In less than 5 minutes, you can complete and submit the application, which includes designating Terra School at Serenbe as the recipient school. You will electronically sign and submit the required Georgia Form IT-QEE-TPI (Qualified Education Expense Credit Pre-approval Form).

1

Once submitted, Apogee will pre-verify your taxpayer information with the Department of Revenue (DOR) for accuracy. Assuming everything is good to go, Apogee will submit your taxpayer information to the DOR on the first business day of 2026. The DOR will mail you a copy of your approval letter in mid-January 2026. Apogee will email you correspondence related to your approved amount, due date, and payment instructions around this time as well.

2

From the date of the approval letter, you will have 60 days to fund your approved tax credit amount. A member of the fundraising committee will also reach out with a reminder. You can make your payment of choice (up to the outlined maximums allowed) by check or credit card to Apogee.

3

Once your contribution is received, you will receive documentation that you are eligible for a tax credit against your Georgia state taxes in the same amount for the current tax year (meaning, the contribution you make in 2026 will go toward your 2026 tax return filed by April 2027).

How much may I contribute?

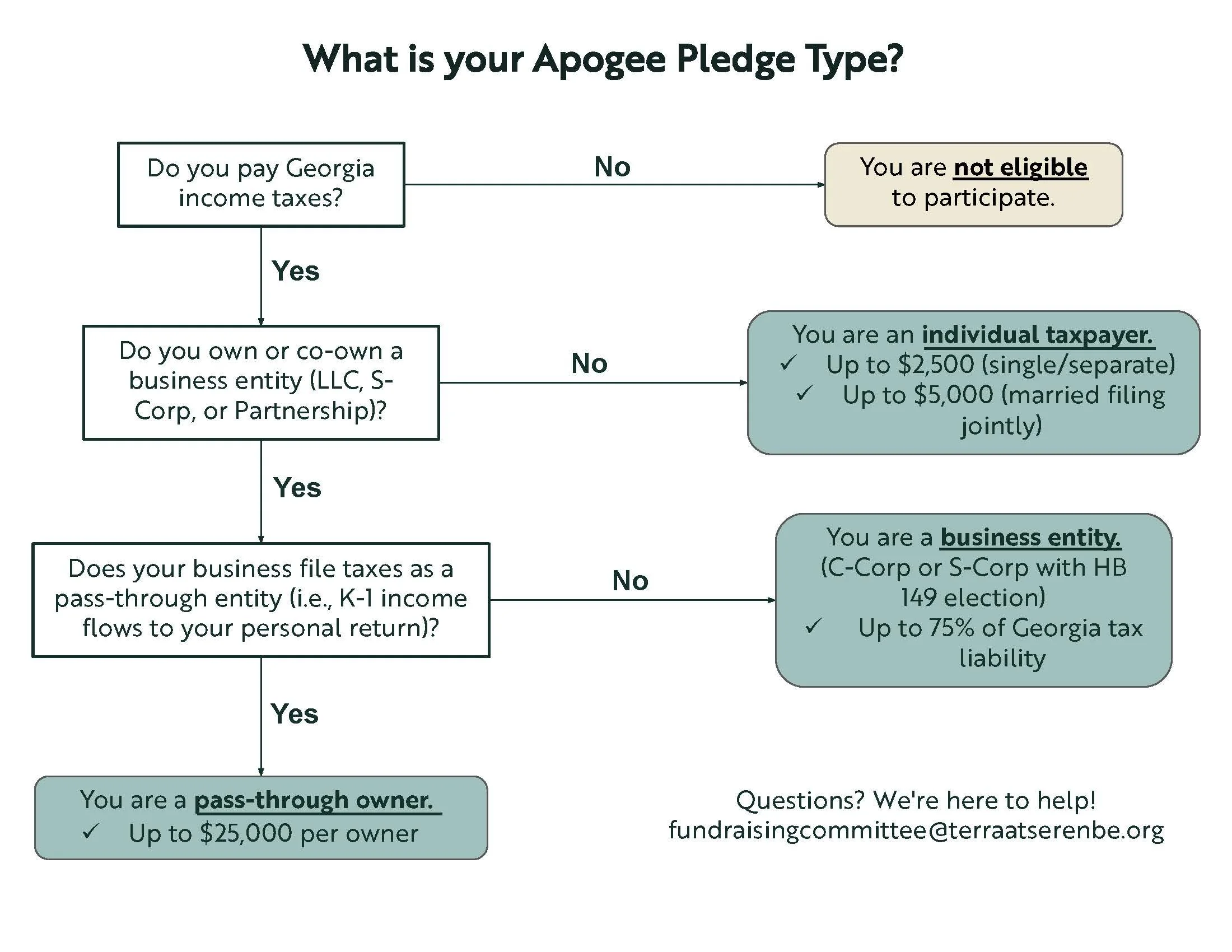

The maximum annual pledge depends on your filing status and type of income:

Individual or married filing separately: $2,500

Married filing jointly: $5,000

Pass-through owner (e.g., K-1 income from an S-Corp, LLC, or partnership): $25,000 per individual/eligible spouse (up to $50,000 per household if both spouses have pass-through income)

C Corporation: Up to 75% of annual Georgia income tax liability

S Corporation electing entity-level tax: Up to 75% of annual Georgia income tax liability

Begin Your Contribution to the Apogee Scholarship Fund

for Terra School at Serenbe

Other Helpful Information and F.A.Q.

-

The more funds we receive from this program, the more financial aid we can offer students applying to certain programs. It’s a win-win in this regard. More students benefit from a Terra School education and our enrollment increases, the learning groups in the classrooms grow and additional revenue fuels the classrooms.

For the 2025-2026 school year, Apogee funds opened the door to 50 students with demonstrated financial need to join the Terra community, allowing them access to an education they wouldn’t have had otherwise.

-

This is a “first-come, first-served” program. The state has placed a yearly cap on the amount of credit available at $120 million. That means that every school, taxpayer, and corporation in Georgia is drawing from the same exact pool of credits. Once the funds are depleted, you will have to wait until the next tax year to participate in the program. Once the funds are deposited, they are immediately available to help families seeking to attend Terra at Serenbe, but otherwise couldn’t afford it.

-

If your family has financial need, your child may be eligible if they meet any of the following:

Entering Pre-K, Kindergarten, or 1st Grade and eligible to attend a Georgia public school

From 2nd grade onward: Has attended a Georgia public school for at least 45 consecutive days immediately before enrolling at Terra

Home-schooled, KIPP, or Georgia charter school students are also eligible

Once your child receives an Apogee scholarship, they remain eligible to receive it through 12th grade as long as they stay enrolled at Terra.

-

Yes. A tax credit is more beneficial to the taxpayer than a strict deduction, because it reduces your tax burden dollar-for-dollar while a deduction reduces the amount of taxable income on which your tax burden is calculated. As a reminder, the dollar-for-dollar credit is for your Georgia state income taxes.

-

You may donate any amount up to the limits allowed. For 2026, your Georgia income tax liability is projected to be 5.19% of your adjusted gross income (AGI). You can also look at Line 18 of your Georgia tax return (Form 500) to learn your Georgia tax liability.

-

Yes! Your estimated payments are only an estimate of your total tax liability divided into four payments. This is a great opportunity to use those funds to support education instead of paying that portion of estimated taxes. Ask your accountant to reduce your quarterly estimated tax payment by the amount of your contribution, which will reduce each of your quarterly payments by 25% of the amount you intend to contribute.

-

The tax credit is a “non-refundable” credit. That simply means that you cannot receive a refund for any more than your Georgia income tax liability. Any excess credit beyond your tax liability can be carried forward for up to three years.

-